Choosing the right online payment processing platform is crucial whether you're starting a new online store or optimizing your existing business. Two industry giants, PayPal and Stripe, have emerged as popular options amongst businesses worldwide. If you're having trouble deciding between PayPal vs Stripe for your business, don't worry—you're not alone.

In this comprehensive guide updated for 2025, we will dive deep into each processor's features, pricing, integrative capabilities, customer support, and more. By the end, you'll be able to confidently select the best payment solution tailored to your business needs.

Table of Contents

- Understanding Online Payment Processing

- PayPal vs Stripe: General Overview and History

- PayPal vs Stripe: Pricing and Transaction Fees

- PayPal vs Stripe: Ease of Use and Integration

- PayPal vs Stripe: Security & Fraud Prevention

- PayPal vs Stripe: Global Payments and Currency Support

- PayPal vs Stripe: Customer Support Reputation

- Conclusion: Should You Pick PayPal or Stripe?

Understanding Online Payment Processing

What exactly is online payment processing?

Simply put, payment processors are platforms that handle transactions made online, facilitating buyers' payments to sellers. In 2025, businesses need a reliable, fast, and secure payment processing system to attract and keep their customers happy.

Online payments typically include:

- Credit cards (Visa, MasterCard, American Express, etc.)

- Debit cards

- Mobile wallets (Apple Pay, Google Pay)

- Digital wallets (PayPal itself)

Importance for businesses in 2025

In the rapidly-evolving digital age of 2025, the demand for seamless, efficient, and secure payments is higher than ever. Choosing the wrong payment processing service can hinder growth, impact customer satisfaction, and ultimately reduce conversions.

PayPal vs Stripe: General Overview and History

PayPal: a trusted traditional player

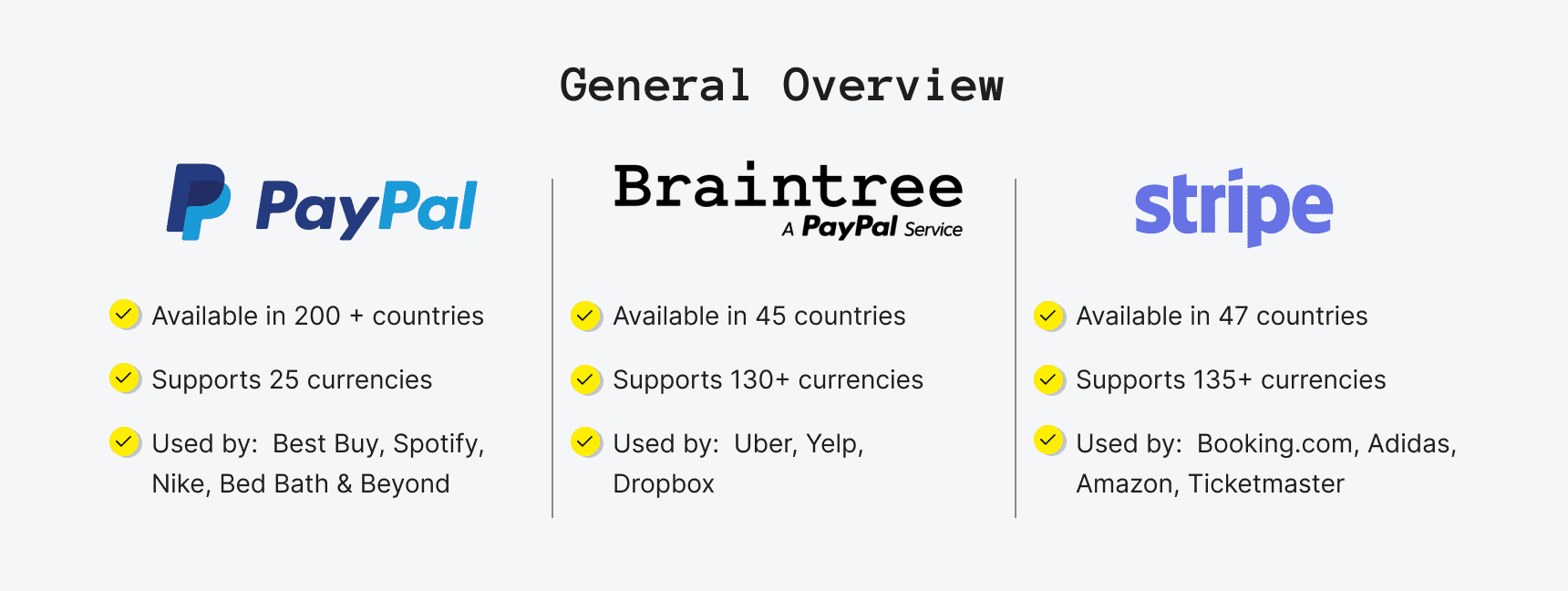

PayPal was founded in 1998, making it one of the earliest providers of online payment solutions. With decades of experience behind it, PayPal is often viewed as the safe choice, boasting strong brand recognition and millions of active users worldwide.

PayPal's popularity skyrocketed partly thanks to its early integration with e-commerce platforms like eBay and Amazon. PayPal now serves over 400 million users globally, covering almost every digital payment scenario imaginable.

Stripe: the modern flexible newcomer

Stripe entered the market in 2010 and quickly became a preferred choice among developers due to its powerful customization options, API-driven integration, and developer-friendly toolkit. Stripe has grown significantly by serving tech-savvy companies and startups needing scalable, flexible payment gateway solutions. Today in 2025, Stripe processes payments for major brands like Spotify, Shopify, Slack, Uber, and more.

PayPal vs Stripe: Pricing and Transaction Fees

PayPal transaction pricing overview

PayPal charges standard transaction fees—2.99% + $0.49 for domestic U.S transactions (updated in 2025). For other currencies, international fees may apply.

Additionally, PayPal has some hidden cost:

- Chargeback fees ($20)

- Currency conversion fees (3-4%)

- Micropayments can be cost-effective with adjusted payments

For more information on PayPal 2025 fees, check their official pricing page.

Stripe pricing policy breakdown

Stripe also offers transparent pricing—2.9% + $0.30 per successful transaction, similar to PayPal’s structure.

Benefits of Stripe pricing:

- No monthly fees or hidden costs.

- Transparent volume discounts if your sales reach certain thresholds.

- Custom pricing for businesses with high volumes.

Stripe’s updated fee schedule for 2025 is available on their official website.

PayPal vs Stripe: Ease of Use and Integration

PayPal: simplified usage

If you prefer simplicity and speed without code, PayPal integration for basic e-commerce is straightforward. Most popular platforms, such as Shopify, WooCommerce, and Wix, provide PayPal integration by default—a fast, efficient plug-and-play solution. New in 2025, PayPal enhanced dashboard analytics provide clearer financial management.

Stripe: ultimate developer control

In contrast, Stripe shines in customization and developer experience. Its API-based setup requires some coding experience but offers tremendous flexibility. Stripe also provides an out-of-the-box hosted checkout solution ("Stripe Checkout") that simplifies integration without extensive coding.

If customization is important to your brand image, then Stripe could be advantageous. Here’s a helpful video guide about setting up Stripe Checkout in 2025.

PayPal vs Stripe: Security & Fraud Prevention

PayPal security features

PayPal, as an industry leader, remains proactive about security awareness. It features:

- 24/7 transaction monitoring

- Advanced encryption

- Excellent fraud detection and mitigation program

- Chargeback dispute management tools.

Stripe security overview

Stripe also prioritizes security with:

- Machine learning-powered transaction surveillance

- Strong seller protection and ransomware protection protocols.

- Multi-factor authentication and compliance with PCI-DSS standards.

Both platforms offer exceptional safety measures, though Stripe’s customizability gives more granular control for developers looking to safeguard users.

Here’s a quick comparison video on security features of PayPal vs Stripe.

PayPal vs Stripe: Global Payments and Currency Support

PayPal’s worldwide recognition

PayPal dominates global recognition, accepted in more than 200 countries and supporting over 25 major currencies. Its popularity worldwide leads to higher consumer trust, reducing cart abandonment. However, certain region-specific restrictions and higher fees may occur when handling international transactions.

Stripe’s expanding global coverage

As of 2025, Stripe supports businesses from 50+ countries and accepts payments from anywhere globally (processing over 135 currencies). Stripe’s international currencies and lower conversion costs are attractive for globally-expanding businesses.

PayPal vs Stripe: Customer Support Reputation

PayPal support quality: mixed reviews

PayPal provides support via email, live chat, and limited phone lines. Frequent criticisms about customer support quality exist, especially for dispute resolutions. Businesses complain about lengthy resolution times, potentially impacting operations.

Stripe’s customer support reputation: Proactive and helpful

Stripe similarly offers email, live chat, and robust knowledge-base resources. Stripe appeals strongly to developers, providing comprehensive documentation and proactive support. The Stripe community often shares knowledge, tips, and solutions actively.

Conclusion: Should You Pick PayPal or Stripe?

Deciding between PayPal and Stripe involves evaluating your business needs, technical proficiency, and your consumer base’s geographic reach.

Choose PayPal if:

- You’re targeting casual users needing fast checkout experiences.

- Require worldwide recognition and maximum consumer trust.

- Want a straightforward integration with minimal customization.

Opt for Stripe if:

- You seek extensive customization options and powerful API integrations.

- Aim to scale internationally with lower currency conversion fees.

- You value detailed documentation, developer resources, and proactive customer support.

Ultimately, both PayPal and Stripe are excellent solutions. Understanding your priorities will clearly point toward the ideal platform suited best for your current and future business success in 2025.

For more expert recommendations, consider this impartial YouTube comparison uploaded recently in 2025 providing unbiased insights into the PayPal vs Stripe debate.